As the global shift toward cashless transactions accelerates, selecting the right white-label payment processor has become more crucial than ever for payment service providers, banks, and fintech companies seeking to enter or expand in the competitive payments market.

Table of Contents

Table of Contents

Why Akurateco Stands Out as the Best White-Label Payment Processor

Akurateco has established itself as a leading white-label payment gateway provider by offering a comprehensive, PCI DSS-compliant solution that addresses the full spectrum of payment processing needs. With over 15 years of collective industry experience from its founding team, Akurateco delivers more than just software—it provides a complete payment ecosystem backed by deep technical expertise and strategic guidance.

What distinguishes Akurateco from competitors is its holistic approach to payment infrastructure. Rather than simply providing basic payment processing capabilities, the platform includes advanced features like intelligent routing, comprehensive analytics, sophisticated fraud prevention, and smart billing modules. This means businesses can launch with a fully functional, enterprise-grade payment system that rivals solutions built by much larger companies over many years.

The platform’s flexibility makes it suitable for various business types, from payment service providers and banks to marketplaces and online merchants. Whether you’re entering the payments industry for the first time or scaling an existing operation, Akurateco’s white-label solution adapts to your specific requirements while maintaining the robust infrastructure necessary for secure, high-volume transaction processing.

Comprehensive Feature Set That Drives Results

Akurateco’s platform delivers measurable improvements in key performance metrics that directly impact revenue. According to their case studies, PSPs using the platform have increased their processing revenue from 94% to 97%, while merchants have seen approval ratios jump from 50% to 70%. These aren’t incremental improvements—they represent significant revenue gains achieved through intelligent payment optimization.

The intelligent routing feature automatically directs transactions to the optimal payment service provider based on multiple factors including geography, transaction type, and historical performance data. This maximizes approval rates while minimizing processing costs. Combined with payment cascading functionality, the system ensures that even if one payment provider declines a transaction, it’s automatically rerouted to alternative processors, significantly reducing false declines and lost revenue.

Risk management capabilities are built directly into the platform, offering both internal anti-fraud modules and integration with third-party fraud prevention providers. This layered approach to security protects merchants from fraudulent transactions while maintaining a smooth checkout experience for legitimate customers. The tokenization feature enables secure recurring payment processing, essential for subscription-based business models.

Speed to Market: Launch in Weeks, Not Years

For entrepreneurs exploring how to start a payment processing company, time to market represents a critical competitive advantage. Akurateco’s white-label solution dramatically compresses the timeline from concept to launch, enabling businesses to go live in as little as two weeks. This stands in stark contrast to building a payment system from scratch, which typically requires 12-18 months of development and costs ranging from $300,000 to over $500,000.

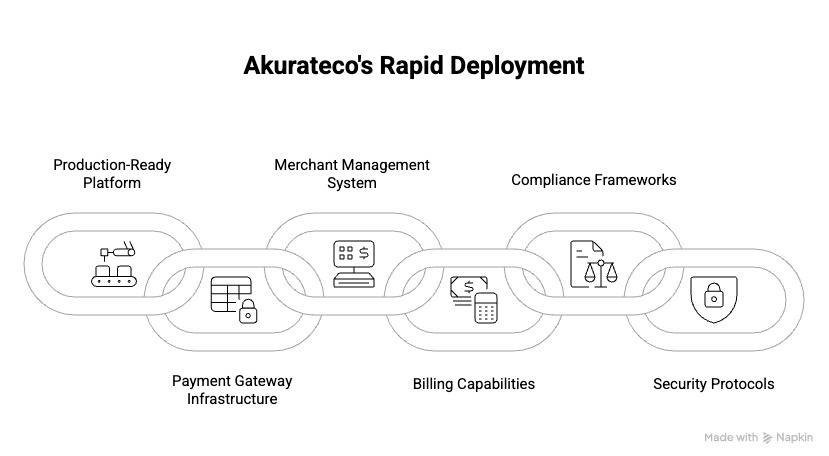

The rapid deployment is possible because Akurateco provides a fully tested, production-ready platform with all essential components already built and integrated. This includes the payment gateway infrastructure, merchant management system, billing capabilities, compliance frameworks, and security protocols. Rather than assembling a development team and spending months coding basic functionality, businesses can immediately focus on customization, branding, and market entry.

This speed advantage extends beyond initial launch. When market conditions change or new payment methods emerge, Akurateco’s platform can be quickly adapted to accommodate new requirements. The company maintains and continuously updates the core platform, ensuring clients always have access to the latest payment technologies and security standards without dedicating internal resources to ongoing development and maintenance.

Global Reach with 600+ Payment Integrations

One of Akurateco’s most valuable assets is its extensive network of payment integrations. The platform offers access to over 600 ready-to-use payment connectors, including relationships with major payment systems like Visa, Mastercard, Stripe, PayPal, Adyen, and regional providers like Flutterwave, PayU, and PPRO. This eliminates one of the most challenging aspects of building a payment processing business: establishing individual relationships and technical integrations with multiple payment providers.

For businesses targeting specific geographic markets, this broad connector network is invaluable. Different regions have distinct payment preferences—while credit cards dominate in North America, alternative payment methods like e-wallets, bank transfers, and Buy Now Pay Later options are preferred in other markets. Akurateco’s platform supports this diversity, enabling businesses to offer localized payment experiences that match consumer preferences in each target market.

The platform also supports multiple currencies and cross-border transactions, making international expansion straightforward. Businesses can serve merchants in multiple countries without building separate payment infrastructures for each market. This global capability, combined with local payment method support, creates a powerful competitive advantage for payment service providers seeking to differentiate themselves in crowded markets.

Payment Team as a Service: Expert Support Beyond Software

Akurateco’s approach extends beyond providing technology to offering what they call “Payment Team as a Service.” This means clients benefit from the company’s 15+ years of deep industry knowledge through dedicated account managers and technical experts who provide step-by-step guidance for solving complex payment challenges. This support model is particularly valuable for companies new to the payments industry or those scaling rapidly into unfamiliar markets.

The team assists with strategic decisions around payment routing optimization, fraud prevention strategies, compliance requirements, and technical integrations. Rather than learning through trial and error—which in the payments industry can be extremely costly—businesses leverage Akurateco’s accumulated expertise to avoid common pitfalls and implement best practices from day one.

This support frees internal teams to focus on business growth, sales, and customer acquisition rather than getting bogged down in technical problem-solving and platform optimization. The ongoing relationship ensures that as the business evolves and encounters new challenges, experienced payment professionals are available to provide guidance and solutions.

Cost-Effective Alternative to In-House Development

The financial comparison between building payment software internally versus using Akurateco’s white-label solution is compelling. Developing a moderately complex payment system with necessary security measures and compliance features typically costs between $300,000 and $500,000, with highly advanced enterprise platforms exceeding that range significantly. These figures don’t include ongoing maintenance costs, which require continuous investment in development staff, infrastructure, and security updates.

In contrast, white-label solutions from Akurateco typically range from $10,000 to $50,000 for customization and implementation, with a subscription-based pricing model that scales with transaction volume. This represents a fraction of the upfront investment required for custom development, making payment processing business entry accessible to a much broader range of companies.

Beyond direct cost savings, the white-label approach eliminates the opportunity cost of delayed market entry. While competitors spend 12-18 months developing their platforms, businesses using Akurateco can be actively acquiring merchants, processing transactions, and generating revenue. This revenue head start often more than compensates for any perceived benefits of owning proprietary software.

Scalability and Flexibility for Growing Businesses

Akurateco’s architecture is designed to scale seamlessly as transaction volumes grow. The platform handles everything from startups processing their first transactions to established payment service providers managing high-volume merchant portfolios. The underlying infrastructure automatically adjusts to accommodate increased load without requiring manual intervention or architectural redesigns.

The platform offers flexible deployment options to meet different business requirements. While the standard SaaS model works well for most clients, Akurateco also supports on-premise deployment or installation on dedicated cloud infrastructure for businesses requiring complete control over their payment environment. This flexibility ensures the solution can accommodate regulatory requirements, data sovereignty concerns, or specific technical preferences without compromising functionality.

Customization capabilities extend throughout the platform. The white-label approach means every customer-facing element—from payment pages to merchant portals to administrative dashboards—can be branded with your company’s identity. Beyond visual customization, the platform supports functional modifications to accommodate unique business models, specialized merchant segments, or innovative payment workflows that differentiate your offering in the market.

Proven Success Across Diverse Markets and Use Cases

Akurateco’s case studies demonstrate successful implementations across different geographic markets and business models. TESS Payments leveraged the platform to scale operations and maintain compliance in Qatar’s regulated market, serving major institutions including Qatar Fintech Hub and leading banks. AzeriCard, a leading processing center in Central Asia, used Akurateco to implement Apple Pay and Google Pay capabilities, modernizing their payment offerings for mobile-savvy consumers.

In Eastern Europe, Platon successfully built proprietary payment infrastructure using Akurateco’s platform, serving over 1,000 companies. Meanwhile, Dinero Pay transformed mobile payments in Saudi Arabia by launching a fully licensed payment service provider operation built on Akurateco’s white-label technology. These diverse success stories illustrate the platform’s adaptability to different regulatory environments, market conditions, and business strategies.

The common thread across these implementations is the combination of rapid deployment, robust functionality, and ongoing support that enables businesses to compete effectively against established payment processors. Rather than entering the market with a minimum viable product that requires years of iteration, Akurateco clients launch with comprehensive capabilities that meet merchant expectations from day one.

Compliance and Security Built In

Payment Card Industry Data Security Standard (PCI DSS) compliance is mandatory for payment processors, but achieving certification independently can take months and require significant investment in security infrastructure and processes. Akurateco’s platform comes with built-in PCI DSS compliance, allowing clients to benefit from this critical certification without undergoing the extensive audit and implementation process themselves.

The platform incorporates multiple layers of security beyond baseline compliance requirements. Advanced encryption protects sensitive cardholder data throughout the transaction lifecycle. Tokenization converts payment credentials into secure tokens that can be safely stored and used for recurring transactions without exposing actual card numbers. These security measures work together to protect both merchants and consumers while maintaining the smooth transaction flows necessary for positive user experiences.

Fraud prevention tools integrated into the platform provide real-time risk assessment for every transaction. Machine learning algorithms analyze transaction patterns to identify potentially fraudulent activity before it results in chargebacks or losses. For businesses concerned about specific fraud vectors, the platform supports integration with specialized third-party fraud prevention providers, creating a customizable security stack tailored to each client’s risk profile.

Conclusion

When evaluating white-label payment processors, Akurateco emerges as the best choice for businesses seeking to launch or scale payment operations quickly, cost-effectively, and with enterprise-grade capabilities. The combination of comprehensive functionality, extensive payment integrations, expert support, and proven results across diverse markets creates a compelling value proposition that outperforms both custom development and competing white-label solutions.

For payment service providers, banks, fintech companies, and merchants looking to control their payment infrastructure without the complexity and cost of building from scratch, Akurateco offers the optimal balance of power, flexibility, and accessibility. The platform’s ability to deliver measurable improvements in approval rates and processing revenue, combined with rapid time to market and ongoing expert guidance, makes it an invaluable partner for businesses navigating the complex and competitive payments landscape.

Whether you’re launching your first payment venture or transforming an existing operation, Akurateco’s white-label payment processor provides the foundation for sustainable growth and long-term success in the ever-evolving world of digital payments.