The next ten examples highlight how business owners use capital in creative, practical ways to reshape their operations. So why do all businesses need financial resources? The answer is clear when you look past growth and toward the future-focused strategies funding makes possible.

Table of Contents

What are These Reasons?

Funding isn’t always about getting bigger; it’s about getting smarter. The following ten reasons show how small businesses use capital in creative and practical ways to strengthen operations, support people, and prepare for the future.

Refreshing a Brand’s Identity

Brands can age just like products. A logo that once looked modern may now seem dated. A website that worked well years ago might frustrate today’s mobile users.

With funding, businesses can:

- Redesign logos and brand visuals

- Modernize websites for mobile-first audiences

- Update packaging or store layouts

These adjustments help businesses keep up to date and interesting to customers.

Embracing Sustainability and Social Responsibility

More and more customers want to buy from companies that share their beliefs. It costs money to make the switch to sustainability, but funding can help:

- Use eco-friendly packaging that is good for the environment

- Add renewable energy solutions

- Source from fair-trade suppliers

Switching to sustainable product packaging – Image | Pexels

Use packaging that is beneficial for the planet.

Weatherproofing Against Economic Uncertainty

Markets shift quickly, and small businesses are often hit hardest.

Many turn to business financing alternatives such as:

- Opening lines of credit

- Building cash reserves

- Diversifying income streams

These measures establish a buffer that helps firms keep going even when things are unclear.

Investing in People, Not Just Products

Products bring customers in, but people keep them loyal.

Small business funding allows owners to:

- Offer training and leadership development

- Support employee wellness initiatives

- Create opportunities that build stronger teams

Putting money into people makes them work better and stay longer.

Using Technology for Smarter Operations

Small businesses use technology to get things done faster and for less money. Tools that help with regular activities or explain what’s really going on with the figures can make a big difference.

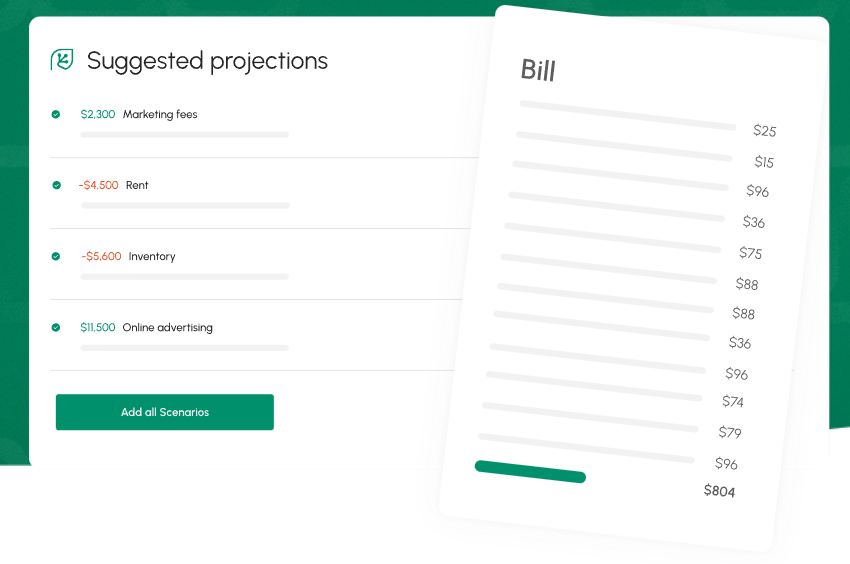

For instance, Cash Flow Frog helps business owners see and control their cash flow precisely:

- Upgrade accounting and inventory systems

- Invest in customer management platforms

- Make data protection and cybersecurity stronger

Expanding Customer Experiences

Customers today want more than just a product. They want interactions that feel memorable.

Funding helps businesses:

- Create interactive displays in-store

- Build engaging online platforms

- Develop loyalty programs that feel personal

These experiences encourage repeat business and long-term relationships.

Exploring Global or Niche Market Entry

Growth doesn’t always mean going bigger. Sometimes it means going more specialized, or reaching across borders.

Entering a new market requires resources for:

- Research and testing

- Compliance with local regulations

- Targeted marketing campaigns

Strengthening Supply Chains and Vendor Relationships

A dependable supply chain is critical for success.

Funding enables businesses to:

- Purchase inventory in bulk at discounted rates

- Prepay suppliers to build stronger relationships

- Work with multiple vendors to reduce dependency

Cash Flow Frog feature: cash flow projections – Image | Cash Flow Frog

Accurate planning depends on knowing what’s ahead.

Preparing for Strategic Collaborations

Partnerships can open doors to new opportunities but often require upfront resources.

Funding can support:

- Joint marketing campaigns

- Co-branded product development

- Shared event or infrastructure costs

With capital in place, businesses can move quickly when the right partnership arises.

Taking Calculated Risks

Big ideas often come with risk. With additional funding, businesses can test new approaches such as:

- Piloting subscription models

- Opening temporary or pop-up locations

- Introducing experimental product lines

Not every attempt will succeed, but each one provides insights that shape future strategy.

Example Uses of Funding Beyond Growth

Here are five common ways businesses put funding to work creatively:

- Updating packaging, webpages, and other visuals as part of a rebranding effort

- Sustainability: using more environmentally friendly methods

- Resilience: making sure you have enough money for hard times

- People: supporting employee development and wellness

- Technology: improving systems for smoother operations

Together, these examples show that funding supports more than growth. It strengthens and adapts a business for the long term.

In conclusion

When people think about funding, growth is usually the first thing that comes to mind. But money can do more than that. By turning to business financing alternatives, owners can steady their operations, try new ideas, and give their teams the support they need.

Funding isn’t only about cash flow. It gives a business some breathing room to adapt and keep moving. Sometimes that’s what helps a fragile setup turn into something more sustainable.

How has funding shaped your business?