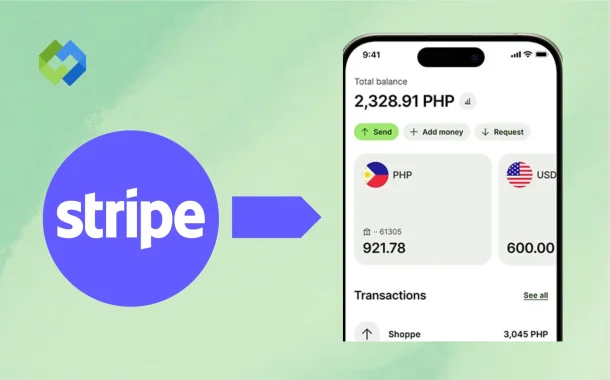

Many users in the Philippines get paid in USD or other foreign currencies through Stripe. But they need the money in PHP (Philippine Peso) to use it locally. Transferring funds to PHP helps them pay bills, buy products, or manage daily expenses. It also helps freelancers and online sellers access their earnings in their local bank accounts.

Table of Contents

Table of Contents

Can You Transfer Stripe Funds to a PHP Bank

Stripe does not directly support payouts to banks in the Philippines. That means you can’t connect a PHP (Philippine Peso) bank account directly to Stripe for withdrawals. Stripe only allows payouts to bank accounts in countries where it operates. The Philippines is not currently on that list.

However, there are workarounds. Many people use services like Payoneer or Wise to receive Stripe funds. These services give you a virtual bank account in a supported country. You can link that account to Stripe, receive payments there, and then transfer the money to your PHP bank account.

Using Third-Party Services for PHP Transfers

Stripe doesn’t support direct bank transfers to the Philippines. So, users in the country need another way to receive funds. That’s where third-party services come in. They offer virtual bank accounts in supported countries like the U.S. or U.K., which you can connect to your Stripe account.

Popular Services to Consider

The most trusted options include Payoneer and Wise (formerly TransferWise). Both let you receive Stripe funds into a virtual account. After that, you can send the money to your PHP bank account. Some users also use GCash, by linking it to a local bank that receives international transfers.

Benefits of Using These Platforms

These services often provide better exchange rates than traditional banks. They also charge lower fees and deliver funds faster. Most importantly, they are secure, legal, and widely used by freelancers and small business owners in the Philippines.

Steps to Withdraw Stripe Funds to a PHP Bank Account

Sign Up for a Third-Party Service

Start by creating an account on a trusted platform like Payoneer or Wise. These services are reliable and widely used for international payments. Complete identity verification and submit necessary documents. Once approved, they will give you virtual bank account details (like a U.S. or EU bank), which can receive Stripe payouts.

Link the Virtual Account to Stripe

Go to your Stripe Dashboard and open the Settings tab. Under Payouts or Bank Accounts, add the virtual bank details from Payoneer or Wise. Stripe will verify the account. Once approved, this will become your main payout method for receiving earnings.

Receive Stripe Payouts

After setup, Stripe will start sending funds to your linked virtual account based on your payout schedule. This could be daily, weekly, or monthly, depending on your account type. You’ll get a notification when a payout is sent.

Transfer to Your PHP Bank Account

Log in to your Payoneer or Wise account once you receive the funds. Choose the Withdraw to Bank option. Enter your PHP bank account details and the amount to transfer. The money is converted to PHP and usually arrives within 1–3 business days, depending on the bank.

Conversion Fees and Exchange Rates Explained

Stripe does not support direct payouts in PHP, so if you’re using a third-party service, the currency conversion happens there. For example, Stripe may pay you in USD to your virtual account on Wise or Payoneer. These platforms then convert USD to PHP before sending it to your local bank. Stripe itself charges a small fee when converting currencies for supported countries.

Exchange Rates Offered by Third-Party Services

Services like Wise often offer real mid-market rates, which are close to what you see on Google. Payoneer may apply a small markup over the market rate. It’s important to check the rate before confirming the transfer. Even small differences in rates can affect your total payout.

Hidden or Extra Fees to Watch For

Besides conversion rates, some platforms charge additional fees for bank withdrawals, fixed fees per transaction, or percentage-based charges. Always read the fee section clearly to avoid surprises. Using platforms with transparent pricing helps you keep more of your money when converting Stripe funds to PHP.

Transfer Time and Processing Delays

Usual Time to Receive Stripe Funds

When you receive payments through Stripe, it usually takes 2 to 7 business days for the money to reach your linked virtual account (like Payoneer or Wise). The exact time depends on your Stripe payout schedule and the country of your virtual bank account. First-time payouts may take longer due to verification.

Time to Transfer to PHP Bank Account

Once the funds are in your Payoneer or Wise account, transferring to your local PHP bank usually takes 1 to 3 business days. Wise is often faster, sometimes completing transfers within a few hours. It depends on the bank you use and whether it’s a weekday or weekend.

Reasons for Delays

Delays can happen due to public holidays, bank processing hours, account verification issues, or incorrect bank details. First-time users may also face extra review times. To avoid delays, always ensure your information is accurate and verified.

Conclusion

Transferring Stripe funds to a PHP bank account is possible with the help of third-party services. Stripe does not directly support PHP banks, but platforms like Wise and Payoneer make it easy. You can link a virtual account, receive your funds, and send them to your local bank.

Always check the fees, exchange rates, and transfer times before moving your money. Use trusted services to stay safe and avoid problems. This method works well for freelancers, small business owners, and online sellers in the Philippines.